Today customer service and user experience analysis play an active role in the financial sector. Customer involvement and their experience on company’s website or using the application becomes more and more important. Constantly working with these tools is more essential than it has been ever before. The fierce competition and wide range of options lets user choose a service provider that can guarantee not only an undisputable reputation, but also an excellent user experience. Page and application load time – as short as possible, quick and secure transaction process, simple and automated file exchange and high-speed resource operations – these elements not only offer a better experience for business clients, but also benefits to the company by generating larger profit as a result of a higher number of transactions and customer loyalty. At the same time, special attention is paid to the security of data processing and storage in order to maintain customer loyalty.

The financial sector has changed significantly over the last year; a large part of people working in the industry has completely stopped producing physical documents as digitalization of both routine procedures and processes continues. Short time ago we could not have imagined some of processes to be done without a human involvement. The necessity to be online 100% of the time has considerably increased the requirements for network capacity, data storage volume and constant accessibility. Banks and financial institutions face challenges arising from large volume data processing and storage every day. The ever-growing IT security threats have significantly increased the expenses connected with prevention of these threats. The rise in expenses has therefore intensified the need to reduce capital investments in IT infrastructure and its maintenance. Often, it does not end with IT; the pressure can also be felt as the necessity to downsize the administrative and IT staff in the name of automated analytics and efficient processes.

Companies in the financial services sector are most often at crossroads: to manage the implementation of quick changes in the existing IT governance methods by concentrating on IT security, or to adopt new service models provided by data centers with the aim of cost reduction, flexibility and efficiency. This blog is devoted to presenting the benefits that DEAC data centers can offer to the financial sector.

Private and strategically extended data centers for quick performance of applications and transactions

Private and strategically extended data centers for quick performance of applications and transactions

Storing information in the data center that is located as close to the user as possible, guarantees the fastest exchange of information between users of resources and information holder. DEAC data centers are strategically situated in the main financial centers of Europe, which helps finance companies operating in several countries use extended, dual low-latency data interchange network that will considerably accelerate financial transactions. Automated e-commerce financial applications demand a stable solution where fast data exchange is the top priority. Latency that interrupts applications’ performance and websites results into losses for you and your clients. One of the simplest and most often used ways of decreasing latency is operating servers that are closer to the points of exchange, i.e., users, which reduces the time spent on data processing. Content delivery as a service goes hand in hand with excellent and constant data interchange, thus creating outstanding user experience for your customers.

Security based on experience and reliable procedures

Security based on experience and reliable procedures

Different normative demands within the financial industry, data security standards for payment cards and other necessary confidentiality requirements affect the choice of the service provider as provider will be the one, who protects and takes care of your data security. DEAC offers a safe and reliable infrastructure with a widely extended communications network combining the largest metropolitan areas in Europe into a one low-latency network. Regular investments in data centers modernization and continuous development of infrastructure are supplemented with conformity to the industry’s latest quality standards that are testified by the following certificates:

Secure payment card data storage, processing and transmitting

MORE

High information security management and protection standards

MORE

Efficient planning and consumption of energy resources

MORE

Effective and innovative technology solutions by Microsoft

MORE

Infinite Possibilities of Big Data Processing and Analytics

Infinite Possibilities of Big Data Processing and Analytics

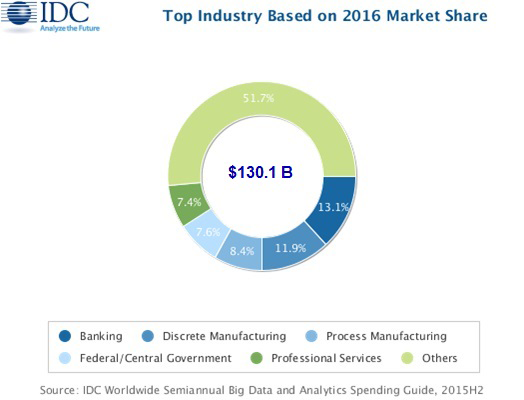

The popularity and use of Big Data increases every year, which ultimately improves understanding of clients’ needs, their experience and behavior models. According to the research conducted by IDC research, the banking sector invests the most money in the analysis of Big Data. This can be explained by the increase in the number of solutions and products created by FinTech companies specifically for banks to manage assets and liabilities.

Finance companies use opportunities presented by the Big Data analytics in order to improve their services, understand the market needs, develop products and create effective marketing campaigns. By analyzing data about customers using different sources, for example, e-commerce operations, CRM, applications, webpages etc. FinTech companies can understand the behavior and needs of their clients and resource users. The analysis gives answers to the questions about the most effective marketing campaigns in terms of client attraction, ways to personalize and sell more services and products to customers and forecasting what users will do next. More and more finance companies see Big Data analytics as a profit generator rather than additional expenses.

As the number of bank clients increases and is expected to continue growing, the small-volume databases of FinTech companies will not be able to manage the increasing volume of information anymore. Therefore, finance companies cannot take advantage of opportunities offered by Big Data analytics, while the capacity of data centers allows processing the ever-increasing volume of information effectively by processing it immediately and in close proximity to the user.

High accessibility

High accessibility

United, global and 24/7 access that ensures fast transaction processing by eliminating any idle time or interruptions are critical elements in the financial and FinTech sector. From trade application software that processes more than a hundred requests in less than a second to authorizations and real-time transactions of credit and debit cards – idle time here can create immense losses. In order to avoid them, IT infrastructure and data exchange network has to be selected with the utmost care. The core of DEAC services is the high accessibility rate or in other words uptime – 99,95% for standard services and 99,99% access guarantee with SLA (increased service level).

Private data centers for a more effective business

Private data centers for a more effective business

Private data centers have been offering tailor made and customized services with high service level to companies within the financial sector for more than 18 years. Certified and experienced experts adjust complex solutions that are based on an extended and dual IT infrastructure in a global scale. DEAC customer data can be stored and processed according to jurisdictions of different countries and taking into account the specifics of the client’s business. Solutions of varied complexity help companies diversify business risks and eliminate any business interruptions. Data backup as a service prevents finance companies from facing disagreeable incidents, while a disaster recovery plan is the most effective solution in case of unexpected circumstances, when business operations have to be restored as fast as possible. Every solution is customized to meet the changing and specific business demands. DEAC certified experts provide high-level consultations and the competency needed to customize services for the financial sector.

Contact us to find out more

Back

Flexible service

Flexible service

Superfast and tailored solutions for specific and complex requirements.

Fast customer support

Fast customer support

Choose the most convenient way to receive fast DEAC support 24/7.

Experienced IT experts

Experienced IT experts

Professional and certified IT support 24/7.